The Impact of the Community Reinvestment Act on Neighborhood Gentrification

Abstract

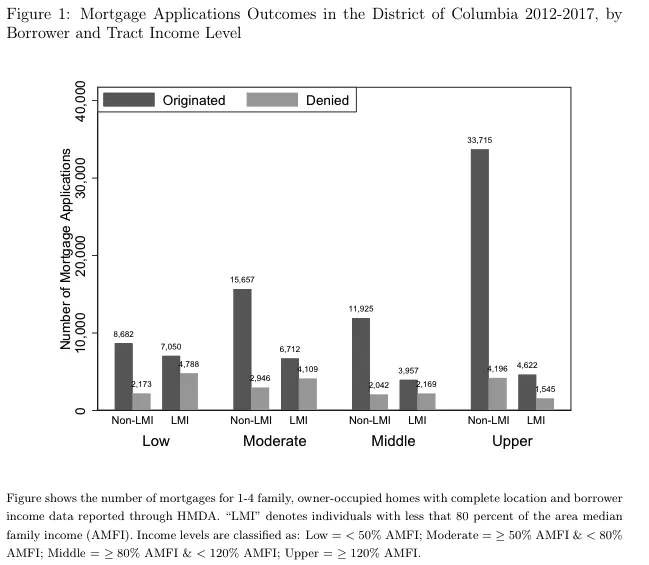

This paper examines whether the Community Reinvestment Act is fulfilling its statutory goal of promoting lending to low- and moderate-income (LMI) communities. We use Home Mortgage Disclosure Act (HMDA) data for the District of Columbia to analyze patterns of bank lending across census tracts. We find that most CRA lending goes to non-LMI borrowers in LMI census tracts, consistent with the hypothesis that banks are “skimming off the top” - lending to less risky borrowers while fulfilling the letter (though not necessarily the spirit) of the CRA. We further explore the question of whether the CRA might be speeding up community gentrification by facilitating lending to higher-income residents moving into historically low-income neighborhoods. In the context of supply-side constraints on housebuilding, this could speed up demographic and socioeconomic changes in CRA census tracts, undermining the financial inclusion objective of the CRA.